Healthcare organizations spend upwards of $50,000 for a single recruiting search on a physician – but the “cost” of lost revenue from vacancies can be much higher and more challenging for rural facilities

by Intelliworx

We recently launched a brand-new software solution called Workforce Management. The product was a year in the making and is intended to help rural healthcare facilities streamline the recruiting process for providers and other healthcare workers.

While we’ve been in the software business for more than 20 years, launching a new product carries inherent risks in a free market. However, we’ve poured a lot of resources into researching the challenges around recruiting in rural hospital settings.

Here’s a sample of some of the secondary research we reviewed, which may provide some insights and benchmarks that are useful to the community.

1. Physician recruiting fees can be up to 35% of annual salary

The search consulting firm Siter-Neubauer & Associates says physician recruiting fees can be as much as 35% of one year’s salary, but there are also hidden costs that can add up. For example, provider vacancies leave gaps in patient care, which in turn, leads to gaps in revenue. Obtaining background checks and other assessments can take up to 4-6 weeks, and adversely impact as much as 25%-50% of annual practice revenue.

Source: 10 real costs of hiring a new physician via Health eCareers.

2. The average cost of a physician vacancy is $7,000-$9,000 per day

Statistics compiled by CompHealth, a staffing firm for healthcare employers, found physician vacancies cost hospitals between $7,000 and $9,000 in lost revenue per day. The average physician vacancy lasts 195 days and the “typical” facility has 87 vacancies annually – so the effects can add up quickly.

Source: 8 ways to reduce your days to fill via CompHealth

3. The top priorities in healthcare recruiting

An annual survey by Jobvite found the top recruiting priorities are:

- Focusing on quality of hires (54%);

- Improving employee retention rates (38%); and

- Reducing time-to-hire (28%).

Source: Healthcare recruiting trends via Jobvite

4. 78% of medical leaders are spending more time on recruiting

More than three quarters (78%) of medical group leaders polled by MGMA said “the amount of time they spend on recruitment and interviewing candidates increased in the past year, while about 16% reported their time commitment stayed the same, and only 6% managed to decrease their time spent in this area.

Source: More job openings, fewer candidates means more time spent by medical group leaders on recruitment via MGMA

5. Top factors influencing physicians to consider rural positions

Rural facilities tend to have a harder time recruiting providers. Yet, nine in 10 physicians surveyed said they would consider a rural position. So, what would motivate them to consider a rural position? A survey of more than 1,300 physicians identified the following:

- 64% higher compensation, bonuses and benefits;

- 47% ability to work part-time or flexible hours;

- 46% improved work/life balance;

- 33% strong organizational culture;

- 29% affordable cost of living;

- 20% additional paid time off;

- 18% offer of loan repayment;

- 17% ability to use telehealth;

- 15% to meet preferences of family/better place for children;

- 15% ability to spend more time with patients;

- 14% proximity to family/friends;

- 14% increased access to hobbies/interests;

- 10% nothing would prompt me to consider; and

- 10% leadership opportunities.

Source: 2022 Rural Physician Recruitment and Staffing Survey Results via Jackson Physician Search and LocumTenens.com

6. 136 rural hospitals closed in the last decade

According to the American Hospital Association, 136 rural hospitals closed in the decade between 2010 and 2021. Of these, 73 completely closed and 63 “converted” meaning they eliminated in-patient services. Importantly, “19 of these closures occurred in 2020, the most of any year in the past decade.”

Why are they closing? “Wany rural hospitals were in precarious financial positions even before the COVID-19 pandemic, and the pandemic has exacerbated the challenges that many rural hospitals were already experiencing, including workforce shortages, limited access to critical supplies and aging infrastructure.”

7. The average employee turnover rate in hospitals is 28%

The average “hospital turnover” rate was about 28% in 2023, a modest 3% reduction compared to the previous year. However, at that rate, hospitals have turned over an astonishing 100%-plus of their workforce in the last five years.

Source: Healthcare Turnover Rates [2023 Update] via DailyPay

8. The average time to fill a healthcare position is 49 days

It takes an average of 49 days to fill a healthcare position, according to a study by Merritt Hawkins, a healthcare recruiting and consulting firm. They’ve calculated a one-day delay in hiring costs $10,122, which works out to $495,978 over 49 days.

Source: The Provider Journey: How Verifiable improves the provider experience and speeds up credentialing via Behavioral Health Tech

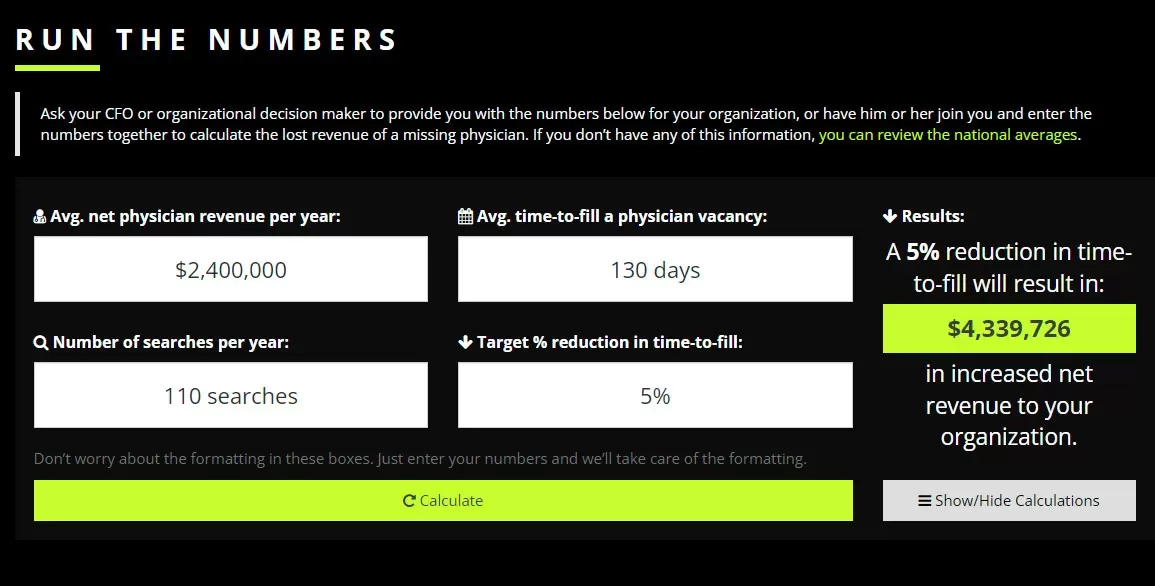

9. A 5% reduction in time-to-fill can yield $4.3 million in revenue

One resourceful healthcare recruiting firm used data from a Merrit Hawkins survey to build a calculator. Physicians generate roughly $2.4 million in revenue for their employers on average. Multiply that by open vacancies and the average time to fill these positions and the calculation shows how a reduction in time-to-fill can dramatically improve revenue.

Source: Run the numbers via The Missing Physician

10. Physician recruiting is harder in rural areas

Just 3% of “newly trained physicians prefer a community of 25,000 or less, while the majority (84%) prefer a community of 100,000 or more. According to the NRHA, only 9% of physicians practice in rural areas though 20% of the overall population lives in rural areas.”

Source: Rural Physician Recruiting Challenges and Solutions by Merrit Hawkins

11. Nurse practitioners are in high demand

Nurse practitioners (NPs) were the “most requested search engagements for the third consecutive year,” among a list of 20 possible specialties, according to AMN (formerly Merrit Hawkins). NPs earn an average salary of $158,000 – up 9% compared to the previous year.

NPs are crucial to rural hospitals. The report notes, “A 2022 study noted that NPs represent more than 25% of primary care providers in rural areas, up 17.6% since 2008. The percentage is higher in those 26 states allowing NPs Full Practice Authority (FPA).”

AMN conducted 2,676 searches between 2022-2023, which is the period of time included in the study. The consulting firm says, “demand for NPs is being driven by a growing number of ‘convenient care’ providers, including retail clinics, urgent care centers and telemedicine platforms, which employ large numbers of NPs.”

Source: 2023 Review of Physician and Advanced Practitioner Recruiting Incentives by AMN

12. Relocation allowances average $12,778 (physicians) and $7,997 (NPs/PAs)

Most (62%) of healthcare employers offered a relocation allowance to prospective providers. That number has trended downward over the last five years, from a high of 98% in 2017-2018. Relocation allowances for physicians averaged $12,778 and $7,997 for NPs and PAs.

Source: 2023 Review of Physician and Advanced Practitioner Recruiting Incentives by AMN

13. Signing bonuses average $37,473 (physicians) and $8,355 (NPs/PAs)

Most (63%) of healthcare employees paid signing bonuses in the last year or so. Physician signing bonuses averaged $37,473 and $8,355 for NPs and PAs. When combined with relocation allowances, health care employers are spending between $15,000 and $50,000 – over and above the cost of recruiting and the loss of revenue due to a vacancy.

Source: 2023 Review of Physician and Advanced Practitioner Recruiting Incentives by AMN

14. A disorganized onboarding process can lead to a revolving door

The risk of costs doesn’t go away after an offer letter has been accepted. Studies have shown, the onboarding process can have a dramatic impact. As many as 4% of employees leave a job after the first day – and about 20% leave within 45 days when onboarding “goes poorly.”

Onboarding in healthcare can be overwhelming with a mountain of paperwork. There are dozens of insurance contracts and credentialing forms to complete, for example. You wind up with multiple people repeatedly asking a physician who’s onboarding for the same information – all of which could be simplified and streamlined with technology.

Source: 10 Ways to Optimize Healthcare Recruiting and Onboarding Processes via PreCheck

15. Payers take as long as 100 days to credential providers

Credentialing providers seems to take “forever,” according to an interview by the Medical Group Management Association (MGMA). Some “payers are taking as much as 100 days to provide an effective date for a new provider and not allowing for any retroactive claims following approval.” It says the “latency in payer response time often results in claims from providers – who have otherwise submitted full, accurate applications – being rejected.”

Source: More than half of practices report credentialing-related denials on the rise in 2021 via the Medical Group Management Association

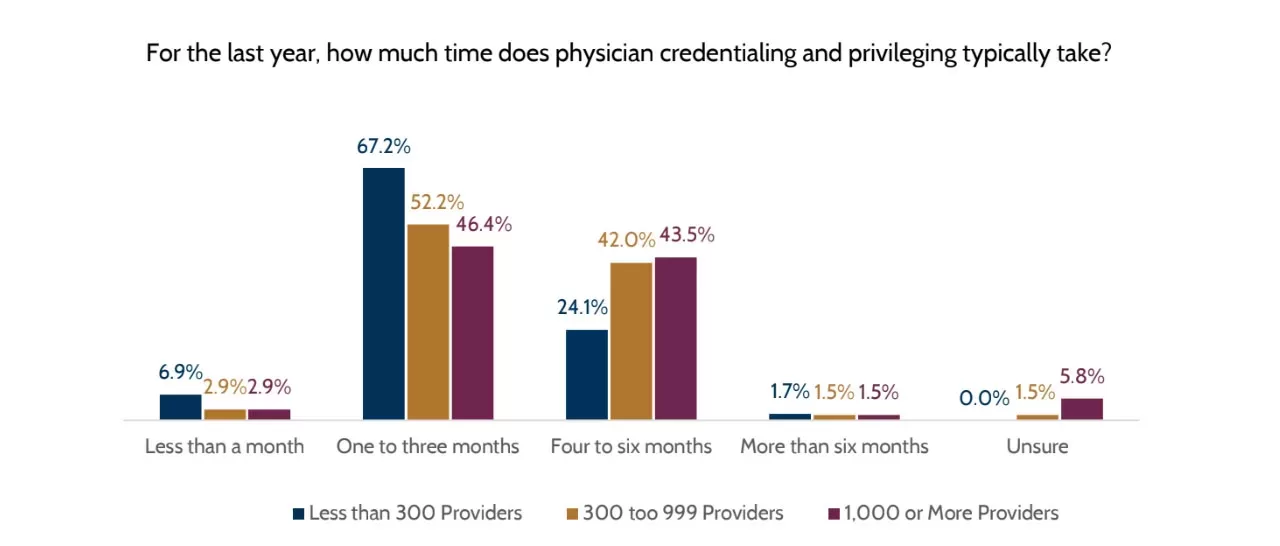

16. Provider credentialing and privileging takes 1-3 months on average

Most healthcare facilities say credentialing and privileging for providers takes 1-3 months on average. Yet a significant number says it can take 4-6 months. Among smaller healthcare facilities – defined in this study as less than 300 providers – the numbers break out like this:

- 7% say credentialing and privileging takes less than a month;

- 67% say it takes 1-3 months;

- 24% say it takes 4-6 months; and

- 2% say it takes six months or more.

Source: 2023 Recruitment Process Report via Association for Advancing Physician and Provider Recruitment (AAPPR)

17. It takes an average of 120 days after acceptance to get a physician started

It’s not just the vacancies and recruiting process that eats up time. A survey found that after a physician has accepted an offer, it takes, on average, 120 days before they start. The report sums it up nicely by noting, “Regardless of organization size, it typically takes four months from when a physician accepts the position to the day they start.”

Source: 2023 Recruitment Process Report via Association for Advancing Physician and Provider Recruitment (AAPPR)

18. “Bad hires” can cost 30% of a provider’s salary

According to the Society for Human Resource Management, a “bad hire” can cost upwards of 30% of that employee’s first-year salary. “The cost of a bad hire includes the direct costs of recruiting and training a replacement, as well as the indirect costs of lost productivity, morale, and customer satisfaction. Hospitals and health systems cannot afford to make poor hiring decisions; the danger is too great.”

Source: Healthcare Recruitment Challenges; The Cost of Making a Bad Hire via PatientCalls

19. The shortage of healthcare workers could get worse

Burnout has unfortunately become common in healthcare. A lot of the blame has been placed on the workload resulting from the Coronavirus pandemic, but things could get worse for another reason: retirement.

There are 2.5 million healthcare workers from the “baby boomer” generation that are poises to retire. Physicians and nurses make up 28% of this group. Some experts estimate the US could face a surrogate of 100,000 doctors by 2030.

Source: Healthcare Recruitment – Ultimate Guide [2023 Strategies] by Recruiteze

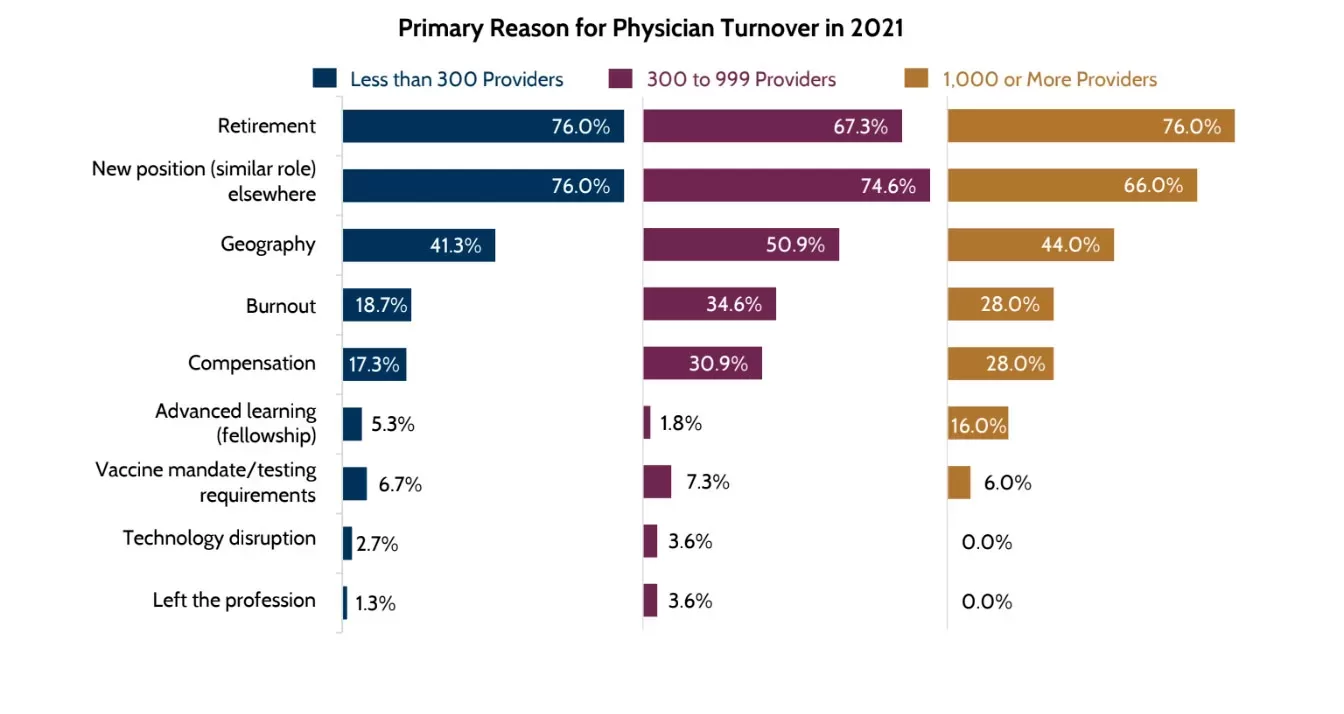

20. The top two reasons providers leave are retirement and compensation

Across the board the top two reasons providers leave are to retire – or for better pay. However, “physicians were much more likely to leave for retirement (32% vs. 5%) while advanced practice providers (APPs) were much more likely to leave for compensation (30% vs. 7%).”

Notably, “providers at the smallest organizations were much less likely to leave due to compensation, burnout, or geography. Once they were there – they stayed. They also had significantly fewer providers retire early.”

Source: 2021 Physician and Provider Retention and Turnover Report via Association for Advancing Physician and Provider Recruitment (AAPPR)

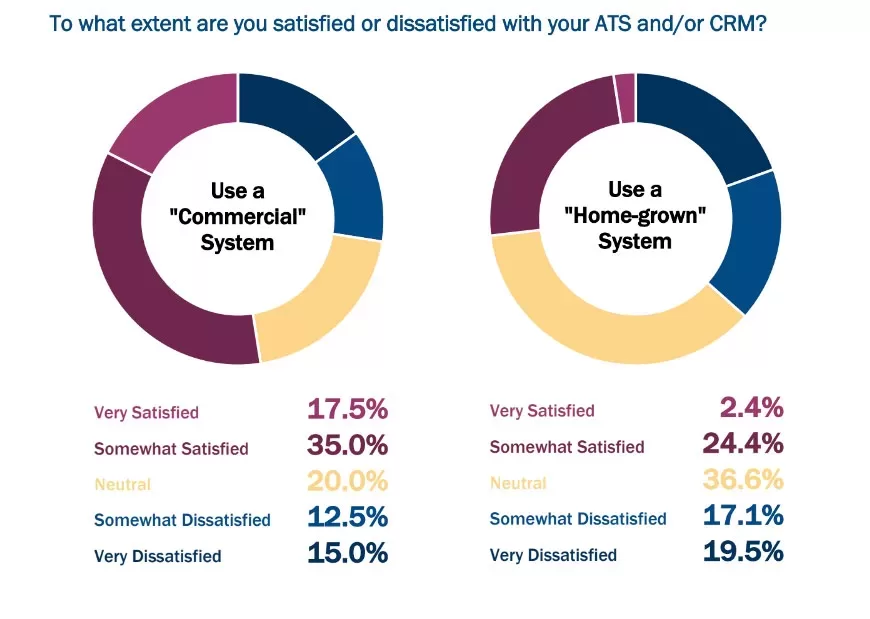

21. Software designed by solution providers preferred to spreadsheets

Nearly four in 10 (37%) of healthcare recruiters track and manage search activities and applications in spreadsheets. However, when asked about their level of satisfaction – compared to professional systems designed by solution providers to manage this process – respondents that used private sector software were twice as likely to say they were “satisfied” or “very satisfied.” There were also some indications suggesting healthcare organizations that used professional systems tend to fill their searches faster than those that do not.

Source: 2019 Physician Recruitment Technology Utilization and Satisfaction Study via Association for Advancing Physician and Provider Recruitment (AAPPR)

* * *

See our new Workforce Management software solution for healthcare for yourself. Contact us for a no-obligation demo.

If you enjoyed this post, you might also like:

Intelliworx Launches New Workforce Management Software for Rural Hospitals