Demand for healthcare has grown as the supply of providers has fallen; this is creating new competition for credentialed talent

by Intelliworx

The shortage of healthcare providers has led to longer wait times for appointments. New patients experience an average wait time that’s 8% longer than it was in 2019. Further, these wait times have grown 24% since 2004.

That’s according to a report titled, 2023 Review of Physician and Advanced Practitioner Recruiting Incentives, by AMN Healthcare (formerly Merritt Hawkins). This has resulted in several new business models, all of which aim to ease access to healthcare but also create new competition for credentialed healthcare talent.

The report identified five new or emerging competitors.

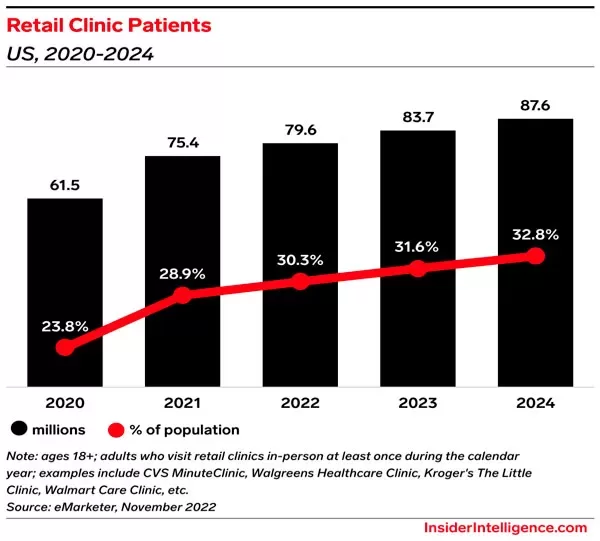

1. Retail pharmacy chains opening up clinics

Pharmacy chains like CVS and Walgreens are investing in clinics run out of their retail locations. Collectively, these clinics experienced patient growth while primary care facilities have seen a decline, according to data from Insider Intelligence that was cited in the report. Even more concerning is the clinics are attracting younger patients while older patients are sticking with their primary care providers.

(click image for higher resolution)

2. Urgent care facilities skyrocket

“Urgent care center utilization was up 1,725% from 2007 to 2016,” which outpaced even emergency departments, according to the report, citing data from FairHealth.

Convenience seems to be the primary driver:

“Both retail clinics and urgent care centers offer same-day appointments, and many have online tools that enable patients to check prices, verify insurance eligibility, and schedule visits. Venues providing convenient care gained patient trust during the pandemic when many patients turned to them for COVID testing and vaccinations.”

AMN Healthcare says they believe this shift will be permanent. They don’t think primary care facilities can win these patients back.

3. Increasing acceptance of telehealth

The pandemic gave telehealth providers a popularity boost with staying power. The report puts it this way:

“According to the Chartis Group, only 8% of patients used telehealth pre-pandemic, compared to 69% who have used it since. The U.S. Department of Health and Human Services (HHS) reports that 5% of physician claims to commercial payors now are for telehealth.”

Telehealth is convenient which is very attractive to patients. As such, AMN Healthcare predicts that “Telehealth platforms such as Teladoc, Amwell, Doctor on Demand and others are likely to expand market share, assuming that Medicare and other payors continue to reimburse for a wide range of telehealth services.”

4. Private equity acquisitions

Private equity (PE) firms have become increasingly active in the healthcare space. The report says M&A activity by PE firms “accelerated during the pandemic when many private practice groups were seeking additional financial resources.” For example, Kaiser Health News reported that in 2021, PE firms invested more than $200 billion on 1,400 healthcare deals. Moreover, PE firms have spent “$1 trillion on 8,000 healthcare acquisitions in the last decade.”

5. Insurance carriers increasingly dabble in providing care

The report notes, “Insurance companies have expanded their role as healthcare providers and now employ physicians in large numbers.” For example, UnitedHealth and its Optum physician network “employs or is affiliated with over 60,000 physicians and is seeking many more.”

AMN says the focus on prevention that carriers have may help “reduce overall utilization,” and while that’s true, it’ll take time to get there. In the meantime, the largest “buyer” of healthcare – insurance carriers – has become yet another competitor for hospitals in recruiting credentialed providers.

The full report contains much more and is available for download here: 2023 Review of Physician and Advanced Practitioner Recruiting Incentives.

* * *

Get your recruiting house in order so you don’t lose out on candidates! Our new Workforce Management software is designed to give rural healthcare facilities an edge in recruiting providers. Contact us for a no-obligation demo.

If you enjoyed this post, you might also like:

7 market dynamics rural healthcare recruiting must navigate in 2024