A growing body of data articulates the frustration healthcare providers have with payers over the growing complications caused by claim denials and prior authorizations

by Intelliworx

Some 44% of healthcare providers have considered leaving their position as a result of the claim denials. That’s according to a still new survey of 211 U.S.-based healthcare providers we recently published (downloadable PDF version here).

Unfortunately, our survey is not an isolated example. Over the last 12 months or so, several other studies have drawn similar conclusions and three of those studies follow below.

1. Providers are “caught in the middle” as denials increase

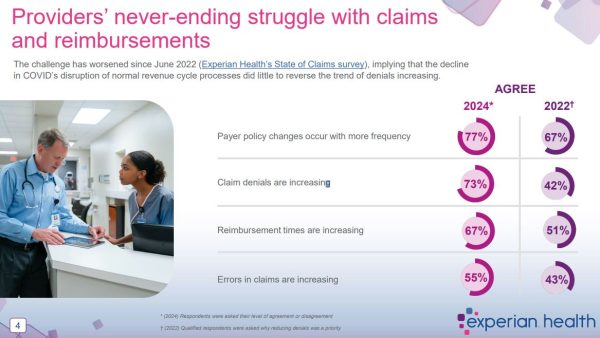

Nearly three quarters (73%) of respondents surveyed by Experian Health said “claim denials are increasing.” More astonishingly, the number jumped dramatically from 42% when compared to the same survey the company fielded two years prior.

Even when claims are approved, providers aren’t done as 67% say payers are taking longer to reimburse claims that do go through. This leaves 77% with concern they might not be paid at all – including 43 percent who were “very concerned” or “extremely concerned.”

“Patients are concerned about healthcare expenses. Payers are watching every dollar. Providers are caught in the middle,” the report said, aptly summing up the issue.

Some of the other statistics that stood out include the following:

- 77% of respondents said “payer policy changes occur with more frequency”;

- 38% of respondents said “claims are denied 10% of the time, or more”

- 11% of respondents said “claims are denied more than 15% of the time”

“This growing crisis is a sign that traditional approaches are no longer enough, and providers should adopt more proactive strategies and the latest technology to navigate this volatility,” said Clarissa Riggins, Chief Product Officer at Experian Health in a press release.

Experian says it polled “210 healthcare staff responsible for administration in finance, billing, registration, reimbursements, claims and collections.” The survey was fielded in the summer of 2024.

Read more: 2024 State of Claims: Healthcare’s dissatisfaction with payer reimbursements continues by Experian Health

(Click for larger image)

2. One in five ACA claims were denied in 2023

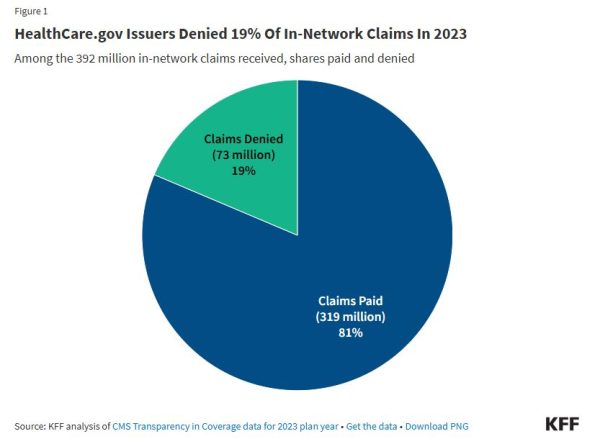

About 1 in 5 claims made to “insurers of qualified health plans (QHPs) sold on HealthCare.gov” were denied in 2023. That’s according to a KFF analysis of data from the Affordable Care Act (ACA) Marketplace. KFF is a nonprofit organization providing health policy research, polling, and news.

According to the analysis:

“Insurers reported receiving 425 million claims in 2023, with 92% (392 million claims) filed for in-network services. Of these in-network claims, 73 million were ultimately denied, resulting in an average in-network denial rate of 19%. Out-of-network claims totaled 33 million, with an overall higher denial rate of 37%. Claims that were initially denied then subsequently resubmitted and paid are not included as denied claims in the denial rate.”

Why are claims denied?

“The most common reason cited by insurers was ‘other’ at 34% followed by administrative reasons (18%), excluded service (16%), lack of prior authorization or referral (9%), and only 6% based on lack of medical necessity.”

Denial rates varied a bit by geographic location, according to the report:

“The state with the highest average in-network denial rate for HealthCare.gov insurers was 34%, in Alabama, and the lowest was 6%, in South Dakota.”

Some states are actively taking steps, with bipartisan support, to address this challenge, a spokesperson for KFF told Stateline, a news outlet covering state policy:

“For example, states such as Arizona, Michigan and Pennsylvania have given their insurance regulators more authority to directly access claims denial information, in order to overturn decisions or potentially enforce state rules.”

Read more: Claims Denials and Appeals in ACA Marketplace Plans in 2023 by KFF

(Click for larger image)

3. It’s not just claims, but prior authorizations too

Claim denials alone don’t capture the entire picture. Some obstacles to claims are introduced earlier in the process with a prior authorization requirement. The American Medical Association (AMA) described prior authorization as “a health plan cost-control process” in a recent report.

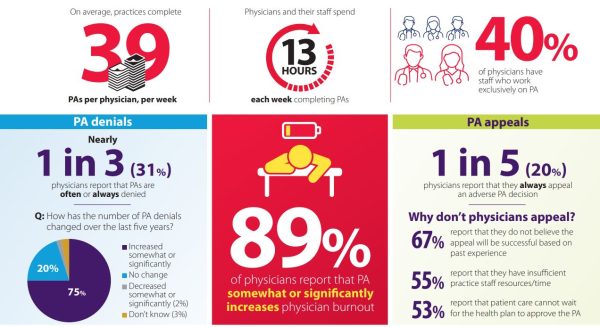

The organization polled 1,000 “practicing physicians” in December 2024 about prior authorizations. Among the findings were the following:

- 94% said prior authorization had a “somewhat or significant negative impact”;

- 93% reported delays in care as a consequence of prior authorization;

- 29% said prior authorization “led to a serious adverse event for a patient in their care”;

- Medical practices average 39 prior authorizations each week at a cost of 13 hours;

- 31% of “physicians report that prior authorizations are often or always denied”; and

- “89% of physicians report that prior authorizations somewhat or significantly increases physician burnout.”

The AMA aptly noted that the second- and third-order effects of prior authorization stretch beyond treatment delays:

“Employers may face reduced productivity if PA causes employees to miss work due to rescheduled appointments or continued illness while waiting for care. In other situations, patients may pay out of pocket rather than endure PA-related care delays. Both scenarios raise serious questions about the overall value proposition of PA.”

Read more: 2024 AMA prior authorization physician survey by the AMA

(Click for larger image)

How does this issue get resolved?

There are no easy answers as the healthcare system we have in the United States is complicated. However, articulating the problem, as these studies do, is the key to getting started. The next step is to impose transparency and implore all stakeholders involved to return to fundamentals, according to Patrick Quigley, co-founder and CEO of Sidecar Health.

His ideas were published in a commentary contributed to MedCity News titled, How High is Too High? The Crippling Cost of Denial Rates.

On transparency, he noted:

“Doctors should be empowered to make medical decisions without interference from insurance. Patients should know exactly what’s covered and what it costs before receiving care. And the entire process should be designed to facilitate care, not obstruct it.”

With respect to the fundamentals, he wrote:

“Payers should pay for care, doctors should provide care, and patients should be empowered to make informed decisions about their care.”

We couldn’t agree more with that sentiment, but undoubtedly, such ideas will take time to build consensus and implement. In the interim, employers would be well advised to lean in on this issue given the enduring shortage of talent, rampant provider burnout and ensuing risks to retention.

For their part, providers seem to agree. In our survey of providers, about 5 in 10 healthcare providers (49%) surveyed say their employers could do more to ease the burden they face in meeting insurance demands.

* * *

The Healthcare Workforce Management solution by Intelliworx is specifically designed to support rural hospitals and healthcare. Check out this short video or contact us for a no-obligation demo.

If you enjoyed this post, you might also like:

The one thing 116 healthcare providers would change about health insurance [verbatim]