Rural healthcare facilities are increasingly turning to nurse practitioners (NPs), international medical graduates (IMGs) and “non-residency” physicians to fill the gaps

by Intelliworx

They say constraint breeds creativity. When faced with limited resources, leaders find ways to apply those resources more effectively. Constraints tend to produce creative thinking that one might not have considered otherwise.

One place we’ve found this to be true is rural healthcare. A persistent shortage of healthcare providers has forced the community, especially in rural areas, to find creative ways to solve this problem. That’s an observation we found woven throughout the 2024 Review of Physician and Advanced Practitioner Recruiting Incentives report.

The report, which is the most current edition available, is produced by AMN Healthcare’s Physician Solutions division – formerly known as Merritt Hawkins. It’s compiled from a range of sources including other studies, surveys and most importantly, a “representative sample of the 2,138” provider talent searches AMN performed during the reporting period.

Below are some of the findings and observations that stood out to us.

1. Overall provider compensation continues to climb

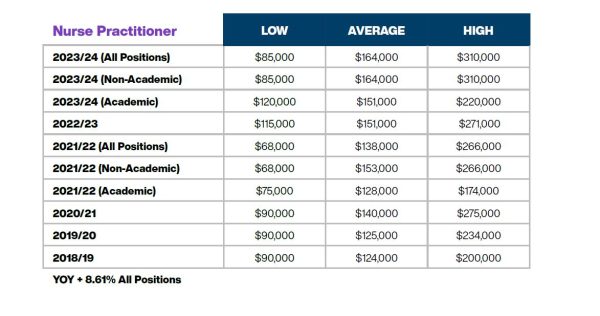

The report confirms the economics of supply and demand. Fewer providers mean there’s a greater need for their skills and healthcare employers are willing to pay more. Indeed compensation grew across most of the specialties that AMN examined – a finding that’s consistent with other independent studies of provider compensation.

For example, “the average starting salary for family physicians was up 6.27% year-over-year, from $255,000 last year to $271,000 this year.” Similarly, “the average starting salary for NPs was up 8.6% year-over-year, from $158,000 last year to $164,000 this year, underscoring the strong demand for advanced practice nurses.”

Here are some sample salary ranges and averages from the report:

- NPs range between $85,000 – $310,000 with an average of $164,000;

- Family physicians range between $120,000 – $460,000 with an average of $271,000;

- OBGYNs range between $275,000 – $700,000 with an average of $389,000; and

- CNRAs range between $235,000 – $416,000 with an average of $279,000.

The report has similar findings for other aspects of compensation such as signing bonuses, relocation expenses and student loan assistance. For example, NPs and physician assistants (PAs) saw average signing bonuses of $11,758 – up from $8,355 a year prior.

Observation: Rural healthcare typically has to offer higher compensation to lure providers away from urban healthcare systems. However, research shows there are other aspects of serving in a rural location that offer intrinsic value. Among the top benefits of rural medicine are a lower cost of living, the ability to spend more time per patient, and a better work-life balance.

(Click for larger image)

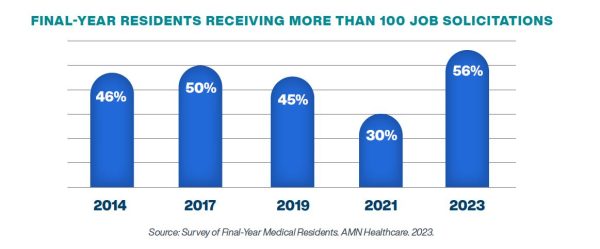

2. Healthcare recruiters are much more aggressive

In this report, AMN cites a 2023 survey of final-year residents that asked about recruiter engagement. That survey found a “majority of residents (56%) said they had been contacted 100 or more times, the highest percent receiving 100 or more job solicitations since the survey was first conducted in 1991.”

Observation: A hundred contacts is a lot of noise to compete with. Consider focusing on quality engagements rather than quantity. Why? A survey we conducted last year found that 45% of healthcare providers will refuse a job offer if the recruiting experience is poor. So, make each of those engagements count.

(Click for larger image)

3. Provider burnout and turnover remains high

Provider burnout has been a contributing factor to the talent shortage for years. The report cites a benchmarking study by the Association of Advancing Physician and Provider Recruitment that found almost half (48%) “of all physician searches in 2021 were to replace departing physicians.” Even more concerning, that number appears to be snowballing – it’s “up by 16% since 2018.”

Observation: Be sure to invest adequate effort in retaining the providers you already have on your team. You can’t “out-recruit” a retention problem no matter how exceptional your HR team might be – the first step in refilling up a leaky bucket is to fix the leaks.

4. CRNAs fill most rural positions

Many medical procedures require anesthesia, so anesthesiologists are often among the most sought-after providers. AMN says this specialty “ranked eighth on our list of most requested search engagements” for this reporting period. Interestingly, when combined with a certified registered nurse anesthetist (CRNA) it ranks third.

According to the report, “CRNAs are particularly important in rural areas.” In rural locations CRNAs “represent approximately 80% of anesthesia providers.”

Observation: The mix of necessity and constraint is a powerful catalyst. The advent of the CRNA and subsequent dominance in rural healthcare is a textbook example of creative thinking in action. The independent practice authority for CRNA has offered the ability for growth in rural areas.

5. Rural healthcare increasingly turns to NPs for primary care

AMN says in the report, that approximately 100 million U.S. citizens live in areas designated by the federal government as Healthcare Professional Shortage Areas (HPSAs). The shortage in rural areas hits hardest in primary care. To fill the gaps, more healthcare systems are turning to NPs for help.

AMN cites peer-reviewed research noting that “NPs represent more than 25% of primary care providers in rural areas, [which is] up 17.6% since 2008.” What’s more, “the percentage is higher in those 26 states allowing NPs Full Practice Authority (FPA).” By contrast, according to the findings, “the percentage of physicians practicing in rural areas declined by 12.8% over the same period.”

Observation: This situation in primary care effectively mirrors the situation with anesthesia. And demand for advanced practice providers (APPs) like NPs has soared as evidenced by the growth in compensation. For example, similar surveys show APPs have seen the biggest jump in salaries among providers.

(Click for larger image)

6. Competition for NPs is growing outside of rural areas

Healthcare employers from all geographies are also very interested in NPs. AMN says for this reporting period “71% of AMN Healthcare’s search engagements were located in communities of 100,000 people or more.” This indicates the “demand for physicians and APPs is not limited to small and/or rural communities.”

More specifically, NPs were the “most requested physician and APP search engagements for the fourth consecutive year.” They are filling roles at “urgent care centers, retail clinics, and telemedicine platforms,” among others.

NPs are also being recruited into specialties. The report says there was a “22% increase in the number of specialty practices that employed NPs” between 2008 and 2016. These NPs are being “mentored by specialty physicians to help provide specialty services and patient education in dermatology, orthopedic surgery, gastroenterology, cardiology” and many others.

Observation: Competition for provider talent is poised to grow stronger before it eases and it’s beyond anyone’s control to solve. What healthcare recruiters and HR professionals can do is focus on what they can control: get your recruiting process organized so you can make the most of your efforts and make a good first impression on talent.

7. Creating paths for IMGs and non-residency physicians

Full Practice Authority for NPs is just one of the changes to healthcare rules and regulations intended to ease the talent strain in healthcare. Tennessee passed a law in 2024 making “it the first state to allow international medical graduates (IMGs) to practice in the U.S. without having to complete a U.S.-based residency training program.”

In addition, “an Illinois law to take effect on January 1, 2025, would allow IMGs without a U.S. residency to practice in the state provided they work in an underserved area. Florida, Virginia, Idaho and Wisconsin are considering similar legislation, underscoring continuing physician shortages around the country.”

Similarly, Alabama passed the Physician Workforce Act which “removes a testing requirement for out-of-state physicians seeking to work in Alabama, allows IMGs to apply for a license a year earlier, and creates an apprenticeship program for medical residents who don’t match into a residency so they can begin training under a physician and apply their skills to patient care.”

In a third example, Missouri “created the position of Assistant Physician, which allows medical school graduates who did not match to a residency to work in patient care.”

Observation: This is perhaps the strongest example of constraints driving creativity. International candidates are likely to have very different needs than traditional medical studies. If this is an area that shows promise for your organization, it may be worthwhile to spend some time understanding what it takes to attract and retain international provider candidates.

A lower projected shortage of providers

If the shortage of provider talent sounds gloomy, there is some good news. Citing forecasts from the Association of American Medical Colleges (AAMC), the AMN report says the U.S. is facing “a projected shortage of 86,000 physicians by 2036.” That’s down significantly from the same forecast issued in 2021, which forecasted “a shortage of up to 124,000 physicians by 2034.”

The full report 2024 Review of Physician and Advanced Practitioner Recruiting Incentives contains many other interesting findings and is well worth taking some time to peruse.

* * *

See for yourself! Our Healthcare Workforce Management software solution is designed to facilitate provider recruiting for rural healthcare facilities. Contact us for a no-obligation demo.

If you enjoyed this post, you might also like:

A Porter’s Five Forces analysis for provider talent in rural healthcare