Filling one physician vacancy: 93 days and $16,000 on average; credentialing adds another 3-4 months before providers can see patients

We spend a lot of time perusing healthcare industry surveys and reports. We especially pay attention to healthcare recruiting and retention in rural areas.

The thinking is simple: it keeps us informed of the challenges our prospective customers face, and by publishing what we find, we’re curating a library of helpful statistics (stay informed: subscribe by email – we will never sell your information).

We easily reviewed a couple of dozen studies this year. Here’s a look back as some of the healthcare statistics about recruiting providers that do well to summarize 2025.

Stay in touch by subscribing to our email newsletter.

We will never share or sell your email address.

1. PCPs earned $300,000; APPs earned $120,000

A benchmark report from MGMA found compensation continues to grow for providers. The report, titled “Provider Pay and the Dawn of a New Era of Productivity,” provides salary information across several categories of providers:

- Primary care physicians earned a little more than $300,000;

- Surgical specialist physicians earned about $550,000;

- Nonsurgical specialist physicians earned about $420,000; and

- Advanced practice practitioners (APPs) earned a little more than $120,000.

Many healthcare employers, particularly in rural areas, are increasingly turning to NPs to help resolve the talent shortage. That increased demand has also placed upward pressure on compensation:

“For APPs, total median compensation outpaced the gains seen for physicians, with a 6.47% increase in 2023, contributing to a 16.23% gain since pre-pandemic 2019 levels.”

For reference, APPs include nurse practitioners (NPs) and physician assistants (PAs) in this report.

Read more: Provider compensation: APPs see the biggest jump in pay

2. Provider compensation can vary by hundreds of thousands $

The delta between the highest and lowest compensation among providers is staggering. You might think a provider stands to make more income working for a big city hospital than they do in a rural community, but that’s not always the case.

That finding comes from the same MGMA compensation data cited above. The report includes examples such as:

- Primary care physicians (PCP) can earn up to $252,379 more annually by working in the highest-paying state in the PCP category (Mississippi) than in the lowest-paying state (Alaska);

- APPs, such as NPs and PAs, can earn up to $67,118 more annually by working in the highest-paying state in the APP category (Nevada) than in the lowest-paying territory (Washington, DC).

Read more: Regional provider compensation – There’s a wide delta between the highest and lowest

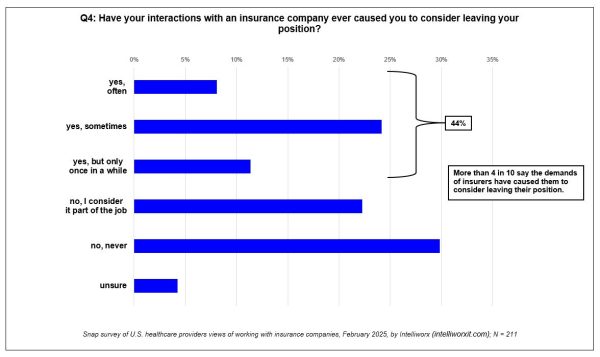

3. 40% of providers have considered quitting because of claim denials

A survey of 211 providers we fielded found most of them chafe when insurance companies second-guess their medical decisions:

- 74% indicate it happens frequently;

- 45% say it takes too much time;

- 44% have considered quitting their jobs as a result; and

- 49% of providers say their employers could do more to ease the burden they face in meeting insurance demands.

It’s not the only survey pointing to this finding either. Several others have described the tension between providers and payers. Providers aren’t shy about expressing what they would change either.

Read more: Healthcare providers express frustration with payers over denied treatments [survey]

(Click for larger image)

4. 74% of healthcare leaders were extended a new job offer

Recruiting and retention challenges extend beyond providers: 74% of healthcare leaders polled said they have been approached with a new job offer recently; nearly half plan to leave in the next 12 months.

That’s according to a survey by B.E. Smith Leadership Solutions, a subsidiary of AMN Healthcare. The survey polled 588 healthcare professionals in leadership roles and spelled out the findings in a report titled 2025 Healthcare Leadership Trends.

While the survey found that most (79%) are generally satisfied with their positions, nearly half (46%) of healthcare leaders surveyed plan to leave their current role in the next 12 months. Further, more than 6 in 10 respondents (65%) said they plan to leave in a 3-5-year window.

Read more: New survey finds healthcare talent woes spreading to leadership

5. Rural healthcare lost 2,500 independent physicians from 2019 to 2024

Rural areas have lost 2,500 independent physicians during a five-year period from 2019 to 2024. That’s according to a data analysis by the Physicians Advocacy Institute and Avalere, a healthcare consultancy.

At the same time, the number of physician-owned practices in rural areas dropped by 3,300. At the same time, the number of physicians employed by corporate-owned health systems increased 10% – from 48% to 58%.

Similarly, the number of “corporate-owned practices more than doubled from 11% to 23%.”

Read more: Why are rural areas losing independent healthcare providers?

6. Recruiting physicians will get 2-3x more competitive

It’s not just the forecasted shortage of 86,000 physicians that makes provider recruiting challenging – it’s also the increase in competition, according to Austin Chatlin, who is a managing director at CHG Healthcare’s advisory services.

He says there are 1,300 new organizations trying to attract and retain providers:

“If you’re going to be recruiting physicians over the next five years, it’s going to be two to three times harder to recruit and retain a physician than it has been.”

Read more: 27 healthcare statistics and benchmarks summarizing the recruiting challenges in 2025

7. 41% of providers plan to leave their job in 2 years

Recruiting providers is only part of the challenge – keeping them is the other – and it’s a growing problem. The Advisory Board and LocumTenens polled 730 clinicians and found 41% of responding providers intend to leave their current position within the next two years.

What is needed for providers to stay? A better culture, schedule flexibility, and work-life balance.

However, there are notable differences when the data is viewed by generational cohort. For example, APPs, including physician assistants (PAs) and nurse practitioners (NPs), place more emphasis on flexible schedules and work-life balance.

Read more: Compensation alone is not enough to attract and retain healthcare providers [study]

8. It takes 3 months and $16,000 to fill a provider vacancy

It took a median of 93 days to fill an open position for a primary care physician, according to the “2025 Physician and Provider Recruitment Benchmarking Report” by AAPPR. APPs came in a bit lower – taking 80 days to fill a vacancy – while searches for specialists took more than twice as long to fill.

The report puts the overall median cost per search by an outside search firm at $15,938. Larger organizations, with 750 or more clinicians paid a median of $18,000 per search. By contrast, those on the low end, with fewer than 200 providers on staff, paid a median of $8,571 per search.

Read more: How long does it take for a healthcare employer to fill a provider vacancy?

9. Credentialling providers required 3-4 months

After a provider is successfully hired, healthcare employers then need to ensure the provider is properly credentialed. The AAPPR survey cited above also found that 70% of responding healthcare organizations say this process takes three to four months. Another 14% said it takes longer, five to six months, while 16% said it takes less time, one to two months.

When you factor in credentialing with the process to fill a provider vacancy, it takes, on average, about six months to fill a provider vacancy and have them in the clinic seeing patients.

Read more: How long does it take for a healthcare employer to fill a provider vacancy?

* * *

See the software for yourself! Healthcare Workforce Management is designed specifically for rural healthcare recruiting: Contact us for a no-obligation demo.

If you enjoyed this post, you might also like:

10 ways HWM helps rural healthcare recruiting shorten time-to-fill